The way Indian companies process salaries has changed forever. Today, the true value of payroll software in India lies not just in calculating salaries correctly, but in how effortlessly it connects with your existing HR and finance systems.

This fully refreshed guide (November 2025) explains everything you need to know about choosing and implementing integrated payroll software in India.

Why Isolated Payroll Systems No Longer Work in India

Using Excel sheets or disconnected payroll tools has become one of the costliest habits for Indian businesses.

Every payroll cycle, teams waste dozens of hours on:

- Re-keying employee information from HR software into payroll

- Manually calculating and verifying TDS, PF, ESI, Professional Tax, and LWF

- Exporting reports and posting journal entries by hand into Tally or ERP

- Correcting mistakes after receiving notices from tax or labour authorities

With frequent budget updates and the gradual rollout of the four Labour Codes, standalone systems are simply not sustainable anymore.

The only practical answer is payroll software in India that connects directly and instantly with your HRMS and accounting platforms.

How Real-Time Payroll Integration Actually Functions

True integration is two-way and happens automatically:

- New employee added in HRMS → instantly appears in payroll with full salary structure

- Daily attendance or biometric logs → flow straight into the payroll engine

- Leave or expense claims approved → automatically adjusted in the salary calculation

- Payroll processed → journal entries posted to accounting software in seconds

- Salary paid → payment status updated back in the payroll records

No manual uploads. No reconciliation spreadsheets. No human errors.

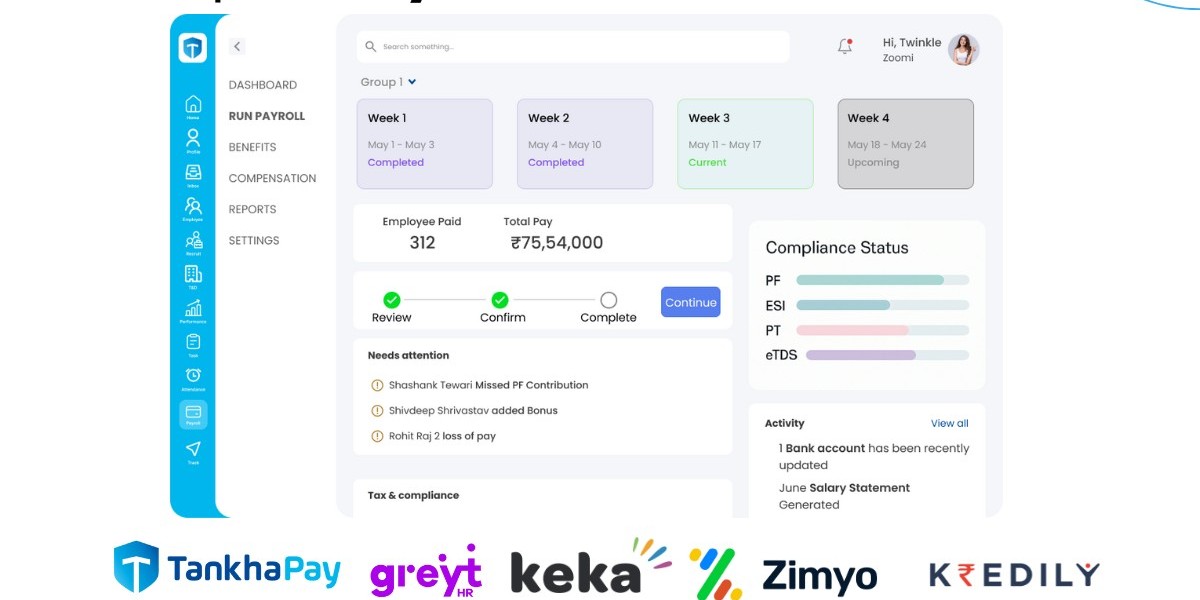

Top 12 Payroll Software in India with Superior Integration Features (2025 Rankings)

| Rank | Platform | Ideal For | Key Native Integrations | Starting Price | Compliance Rating |

|---|---|---|---|---|---|

| 1 | greytHR | Medium & large organisations | Tally, QuickBooks, SAP, Oracle, Zoho, 50+ | ₹39/employee/month | 99.8% |

| 2 | Keka | Fast-growing startups & SMEs | Tally, QuickBooks, Xero, Zoho Books | ₹49/employee/month | 99.5% |

| 3 | Zoho Payroll | Businesses already on Zoho | Zoho People, Zoho Books, Zoho Expense | ₹50/employee/month | 99.4% |

| 4 | RazorpayX Payroll | Instant salary payments | Razorpay, Tally, Zoho People | ₹40/employee/month | 99.0% |

| 5 | Pocket HRMS | Traditional & manufacturing | Tally, Busy, Marg, SAP | ₹35/employee/month | 98.8% |

| 6 | Spine HR | Large factory workforces | Tally, SAP, Oracle | ₹45/employee/month | 98.5% |

| 7 | HRMantra | High customisation requirements | 70+ ERPs (Dynamics, SAP, Oracle) | ₹60/employee/month | 98.7% |

| 8 | Zimyo | Emerging companies | Tally, Zoho, QuickBooks | ₹40/employee/month | 98.4% |

| 9 | WalletHR | South-India focused firms | Tally, Focus, custom ERPs | ₹30/employee/month | 98.0% |

| 10 | Sumopayroll | Budget-first startups | Tally, Zoho Books (free tier available) | Free – ₹25/emp | 97.5% |

| 11 | Opfin | CA firms & accounting practices | Tally Prime, Busy | ₹5,000 flat/month | 99.0% |

| 12 | Paybooks | Simplicity + compliance | Tally, QuickBooks | ₹39/employee/month | 98.2% |

Real-World Example: greytHR + Tally Prime (India’s Favourite Combination)

Process followed by thousands of companies in 2025:

- Finish payroll in greytHR

- Click “Send to Tally”

- Within seconds, Tally receives perfectly mapped entries:

- Salary expenses broken down by department & cost centre

- Separate liability ledgers for TDS, PF, ESI, PT (employer + employee portions)

- Ready bank payment vouchers

Total time for a 1,000-employee company: under 3 minutes.

Cutting-Edge Features Available Only in Integrated Payroll Software in India

- Automatic updates for new Labour Codes and budget changes

- Aadhaar-enabled and facial recognition authentication

- Built-in earned wage access and instant salary advances

- Direct API-based salary credit (no more NEFT/RTGS files)

- Payslips & Form-16 delivery via WhatsApp and chatbot

- AI-driven anomaly alerts (duplicate entries, unusual overtime, etc.)

Quick ROI Snapshot

| Organisation Size | Hours Saved Monthly | Annual Cost Savings | Typical Penalties Avoided |

|---|---|---|---|

| 50 employees | 30–40 hrs | ₹4–7 lakh | ₹1–4 lakh |

| 200 employees | 80–100 hrs | ₹14–22 lakh | ₹8–20 lakh |

| 1,000+ employees | 300+ hrs | ₹50–90 lakh | ₹25+ lakh |

Smooth Migration Roadmap (6–8 Weeks)

Week 1: Select and sign with your chosen payroll software in India Week 2–3: Upload employee masters and salary structures Week 4: Configure integrations and ledger mapping Week 5: Run parallel payroll + train users Week 6: Go live confidently

Almost every reputed vendor now provides free data migration and a dedicated onboarding manager.

Warning Signs – Avoid Payroll Tools That Still:

- Require monthly Excel uploads

- Have no public API documentation

- Charge separately for basic Tally/QuickBooks connectors

- Lack a proper employee mobile app

- Offer only email-based support

What’s Coming Next (2026–2030)

- Completely hands-free, AI-powered payroll runs

- Blockchain-verified digital payslips

- Real-time old vs new tax regime switching during processing

- Direct API connectivity with government labour portals

- Embedded personal finance, insurance, and investment options

Final Recommendation

In 2025–26, running payroll without deep HRMS and accounting integration is no longer a viable option for any serious Indian business.

The difference between market leaders like greytHR, Keka, and Zoho Payroll and the rest of the pack has never been wider.

Take action today: Shortlist the top three solutions from the table that already support your current HR and accounting tools. Schedule demos or start their free trials (most include full integration testing).

Stop treating payroll as a monthly headache. Switch to modern, fully integrated payroll software in India — and turn one of the most stressful processes into the smoothest one in your organisation.