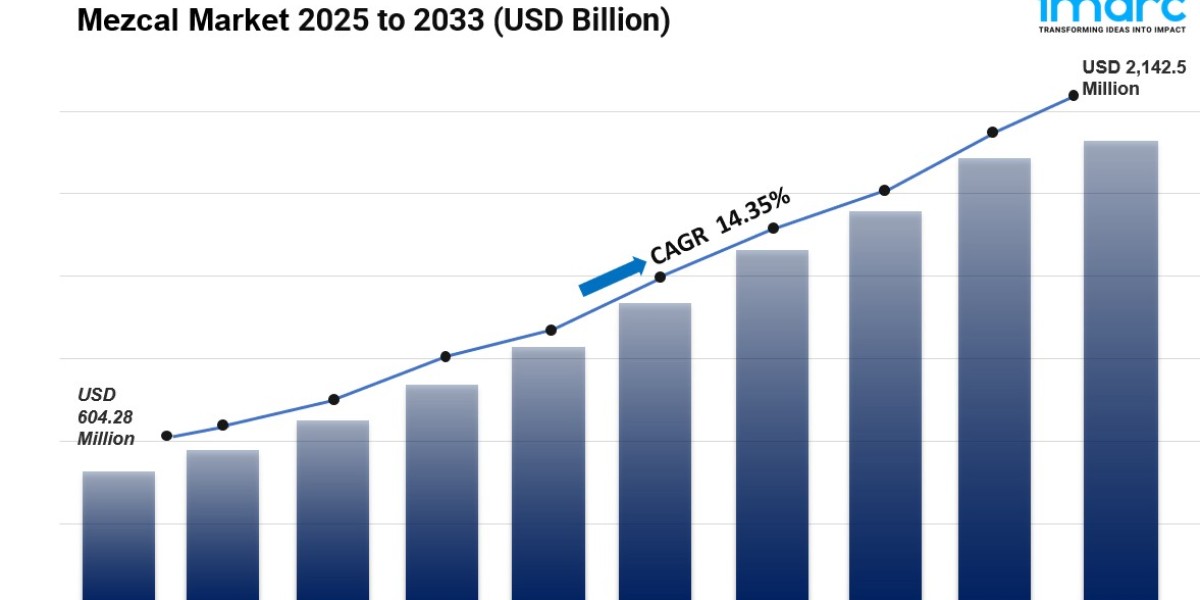

The global mezcal market was valued at USD 604.28 Million in 2024 and is projected to reach USD 2,142.5 Million by 2033. The market is anticipated to grow at a CAGR of 14.35% during the forecast period from 2025 to 2033. Growth is driven by increasing demand for craft and artisanal spirits, expanding cocktail culture, and rising global distribution.

The global Mezcal Market Size is growing steadily as consumers show increasing interest in premium, artisanal, and authentic alcoholic beverages. Mezcal’s distinctive smoky flavor, traditional production methods, and strong cultural heritage are attracting both seasoned spirits drinkers and younger consumers seeking unique drinking experiences. The rise of cocktail culture, premium bars, and craft spirit brands is further supporting market expansion. In addition, growing international awareness and expanding distribution channels are making mezcal more accessible beyond its traditional markets. As demand for premium and craft spirits continues to rise, the mezcal market is expected to maintain consistent growth in the years ahead.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

Mezcal Market Key Takeaways

- Current Market Size: USD 604.28 Million in 2024

- CAGR: 14.35%

- Forecast Period: 2025-2033

- North America dominated the market with a 54.7% share in 2024.

- Mezcal reposado comprised the largest product segment in 2024 with 58.7% market share.

- On-trade distribution channels led with 68.9% market share in 2024.

- The United States holds 83.50% of North America’s mezcal market.

- Rising interest in premium and craft spirits fuels market growth globally.

Request a Sample Report: https://www.imarcgroup.com/mezcal-market/requestsample

Market Growth Factors

The global mezcal market is growing due to a rising demand for craft spirits, which are defined by small-batch production and artisanal methods. In 2024, the global alcoholic beverages market reached USD 1,616.6 Billion, reflecting a shift towards unique and sophisticated drinking experiences. Mezcal’s traditional production involves roasting agave hearts in underground pits and natural fermentation, producing complex flavors that enhance its appeal as a craft spirit. Increasing availability in premium bars, restaurants, and retail outlets, along with growing awareness of sustainable and organic production methods, is further driving the market.

Consumer preference for unique flavors is another key growth driver. Mezcal offers diverse flavor profiles ranging from smoky and earthy to fruity and herbal, making it a preferred ingredient for bartenders and mixologists crafting innovative cocktails. The sector benefits from a 13% increase in cocktail orders post-pandemic, with 7.4 million people ordering cocktails at bars and clubs. This expanding cocktail culture continues to boost mezcal demand globally as consumers seek novel and adventurous flavor experiences.

Growing demand for premium spirits also propels the market, as consumers increasingly seek authenticity, heritage, and high-quality ingredients. Small-batch and aged mezcal variants are gaining popularity, supported by mixology trends, celebrity endorsements, and the expanding export market from Mexico to regions like the US and Europe. The trend towards premiumization includes innovations such as creative aging processes and organic designations, positioning mezcal as a luxury craft spirit. Furthermore, rising international tourism enhances consumer exposure to mezcal, contributing to its sustained market expansion.

Market Segmentation

Analysis by Product Type:

- Mezcal Joven: Not detailed in source.

- Mezcal Reposado: Largest segment in 2024 with 58.7% share; aged in oak barrels developing complex flavors appealing to premium consumers, offering smoothness and balanced taste preferred over joven.

- Mezcal Anejo: Not detailed in source.

Analysis by Distribution Channel:

- On-Trade: Leading channel with 68.9% share in 2024; bars and restaurants drive growth through curated tastings, cocktail culture, and education increasing mezcal awareness and repeat purchases.

- Off-Trade: Not detailed in source.

Regional Insights

North America is the dominant region in the mezcal market, accounting for 54.7% of the global market share in 2024. The United States leads within this region, holding 83.50% of North America’s mezcal market. Growth is supported by the expanding cocktail culture, increasing consumer preference for premium spirits, and extensive retail and online distribution channels, which enhance product accessibility and awareness.

Recent Developments & News

- March 2025: Tesla launched a limited-release mezcal in collaboration with Nosotros, blending Espadín and Bicuishe agave in a black lightning-bolt-shaped bottle.

- January 2025: Run the Jewels introduced Juice Runners, a ready-to-drink cocktail line including a canned Paloma with mezcal.

- October 2024: Erin and Abe Lichy launched Mezcalum, now available in 800 retail and on-trade locations.

- July 2024: Edna's Non-Alcoholic Cocktail Company released Mezcalita, a non-alcoholic cocktail replicating traditional mezcalita smoky notes, with preorders across the USA and Canada.

- April 2024: The Whisky Exchange announced its Tequila and Mezcal Show in London for May 16-17, 2025, reflecting a 34% growth in agave spirits sales.

Key Players

- Bacardi Limited

- Desolas

- Destileria Tlacolula Inc.

- Diageo plc

- Drink Monday

- El Silencio Holdings Inc.

- IZO Spirits

- Lágrimas de Dolores

- Pernod Ricard SA

- Rey Campero

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.