IMARC Group has recently released a new research study titled “Mexico Freight Transportation Market Size, Share, Trends and Forecast by Offering, Transport, End Use, and Region, 2025-2033”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

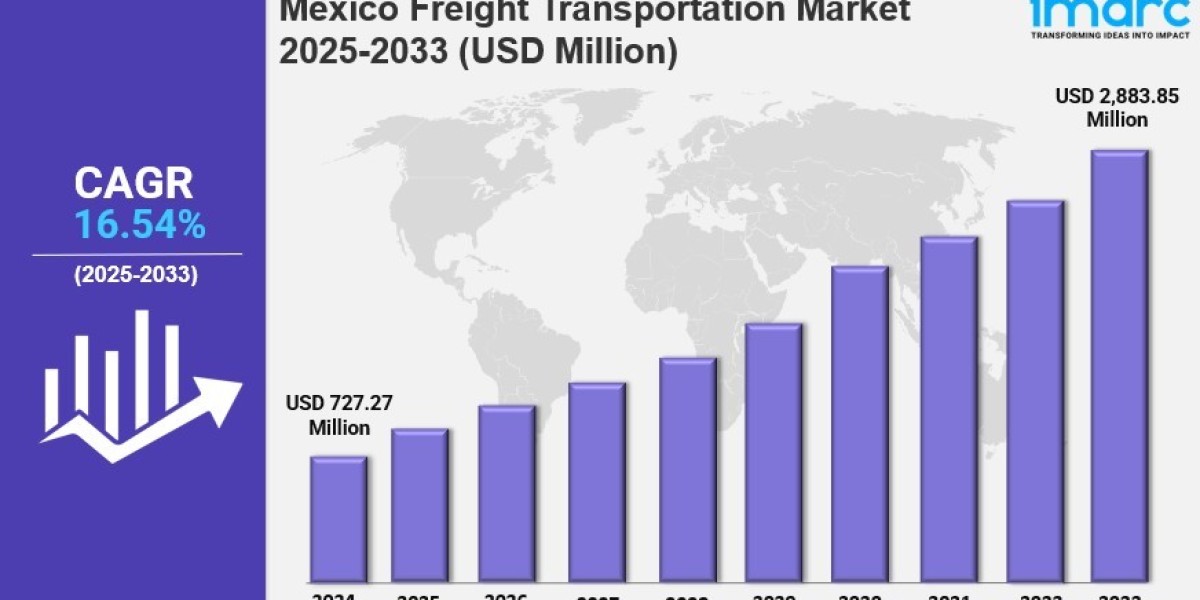

The Mexico freight transportation market size reached USD 727.27 Million in 2024 and is projected to grow to USD 2,883.85 Million by 2033, exhibiting a CAGR of 16.54% during 2025-2033. Growth is driven by technological innovations such as automation and real-time tracking that streamline operations and reduce costs. Strategic proximity to the U.S. and trade agreements like USMCA boost trade activity, creating steady demand for freight transportation. Infrastructure investments in highways and ports further improve logistics network efficiency.

Study Assumption Years

● Base Year: 2024

● Historical Years: 2019-2024

● Forecast Period: 2025-2033

Mexico Freight Transportation Market Key Takeaways

● Current Market Size: USD 727.27 Million in 2024

● CAGR: 16.54% during 2025-2033

● Forecast Period: 2025-2033

● Technological advancements, including automation and real-time tracking, are major growth drivers enhancing logistics efficiency.

● Mexico’s proximity to the United States and trade agreements like USMCA facilitate robust cross-border freight activity.

● Investments in transportation infrastructure such as highways, rail systems, and ports are improving network connectivity and capacity.

● Nearshoring trends have increased truck freight demand, with a reported 10% year-over-year increase in Mexican truck freight in 2024.

● Expansion of cross-border services by companies like XPO and enhancements in border crossing facilities support faster and more reliable shipments.

Sample Request Link: https://www.imarcgroup.com/mexico-freight-transportation-market/requestsample

Market Growth Factors

The Mexico freight transportation market growth is primarily driven by ongoing technological advancements that improve logistics efficiency, optimize supply chains, and enhance overall transportation operations. Automation and real-time tracking systems allow companies to streamline delivery processes, reduce transit times, and lower operational costs. Predictive analytics enable more efficient route planning based on real-time data, while digital platforms increase transparency and shipment monitoring, meeting increased demand for reliable and faster transportation.

Another significant growth factor is Mexico's strategic geographical proximity to the United States and the impact of trade agreements such as NAFTA and its successor USMCA. These agreements have facilitated streamlined trade processes, making Mexico a key partner in North American supply chains. For instance, Mexican truck freight reached approximately USD 78 billion in December 2024, driven by a 10% year-over-year increase emphasizing nearshoring trends where manufacturing shifts from China to Mexico.

Infrastructural investments also play a crucial role in market expansion. Mexico has upgraded highways, modern rail systems, and port facilities to improve trade flow within the country and with international markets. The government promotes these projects to boost competitiveness and attract foreign investment. Developed transportation infrastructure supports more efficient freight movement, thereby propelling market growth.