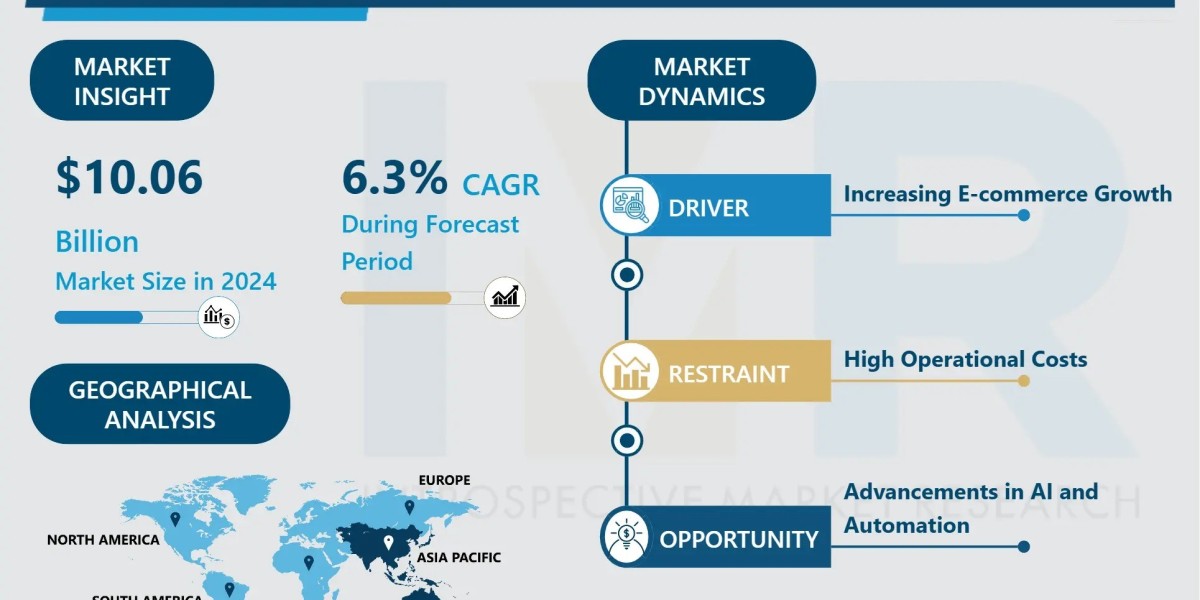

According to a new report published by Introspective Market Research, Fifth-Party Logistics Market by Service Type, End-User, and Solution, The Global Fifth-Party Logistics Market Size Was Valued at USD 10.06 Billion in 2024 and is Projected to Reach USD 16.4 Billion by 2032, Growing at a CAGR of 6.3%.

Market Overview:

The global Fifth-Party Logistics (5PL) market represents the forefront of supply chain evolution, providing comprehensive, tech-driven management of an organization’s entire logistics network through a single strategic partner. Unlike traditional 3PL or 4PL providers, a 5PL integrator leverages advanced technologies like the Internet of Things (IoT), Artificial Intelligence (AI), and big data analytics to orchestrate and optimize multiple supply chain partners, including other logistics providers. This model offers unparalleled advantages: end-to-end visibility, dynamic optimization, significant cost reduction, and the agility to adapt to volatile market demands by managing complexity at scale.

5PL solutions are critical for businesses navigating the complexities of modern global commerce. Their primary applications span major industries such as retail & e-commerce, manufacturing, automotive, and healthcare, where intricate, multi-modal supply chains are the norm. By providing a unified control tower, 5PLs enable companies to focus on core competencies while ensuring seamless logistics execution. The rise of omnichannel retail, the demand for hyper-transparency, and the relentless pressure for efficiency are driving enterprises to adopt this integrated, strategic logistics model, positioning 5PL as a key enabler of competitive advantage and resilience.

Growth Driver:

The primary growth driver for the 5PL market is the exponential rise of global e-commerce and the resulting demand for hyper-efficient, agile, and transparent supply chains. The complexity of managing omnichannel fulfillment, last-mile delivery, and reverse logistics across vast geographical networks has overwhelmed traditional in-house and fragmented 3PL models. Companies are increasingly seeking a single, strategic partner that can leverage digital technologies to orchestrate the entire ecosystem, optimize routes in real-time, manage inventory visibility, and ensure customer promise fulfillment. This shift towards outsourced, technology-integrated total logistics management is fueling widespread adoption of the 5PL model.

Market Opportunity:

A pivotal market opportunity lies in the development and provision of AI-powered, prescriptive supply chain platforms as a core 5PL offering. Moving beyond visibility and basic optimization, there is immense demand for solutions that use machine learning to predict disruptions, automate decision-making, and prescribe corrective actions autonomously. Furthermore, integrating blockchain technology for immutable track-and-trace and smart contracts can offer new levels of transparency and trust. 5PL providers that can deliver these "supply chain brain" platforms will capture high-value clients, particularly in sectors like pharmaceuticals, high-tech, and perishable goods, where precision and reliability are paramount.

Fifth-Party Logistics Market, Segmentation

The Fifth-Party Logistics Market is segmented on the basis of Service Type, End-User, and Solution.

End-User

The End-User segment is further classified into Retail & E-commerce, Manufacturing, Automotive, Healthcare, and Others. Among these, the Retail & E-commerce sub-segment accounted for the highest market share in 2024. This sector's dominance is driven by the relentless growth of online shopping, which demands flawlessly integrated logistics for inventory management, rapid order fulfillment, cross-border shipping, and returns handling. The extreme complexity and customer-centric nature of e-commerce supply chains make the holistic, tech-enabled orchestration offered by 5PL providers not just beneficial but essential for scalability and customer satisfaction, solidifying this segment's leading position.

Solution

The Solution segment is further classified into Logistics Network Optimization, Supply Chain Planning & Execution, Integrated IT Platform, and Others. Among these, the Integrated IT Platform sub-segment accounted for the highest market share in 2024. The core of a 5PL offering is its technology stack—a unified platform that aggregates data from all logistics partners, provides real-time visibility, and enables centralized control. The dominance of this solution underscores that the primary value proposition of 5PL is technological integration, allowing clients to manage their entire, often fragmented, logistics network through a single pane of glass.

Some of The Leading/Active Market Players Are-

- DHL Supply Chain (Germany)

• Kuehne + Nagel International AG (Switzerland)

• DB Schenker (Germany)

• C.H. Robinson Worldwide, Inc. (United States)

• XPO Logistics, Inc. (United States)

• GEODIS (France)

• CEVA Logistics (CMA CGM Group) (France)

• DSV A/S (Denmark)

• Nippon Express Holdings, Inc. (Japan)

• FedEx Corporation (United States)

• United Parcel Service, Inc. (UPS) (United States)

• Agility Logistics (Kuwait)

• and other active players.

Key Industry Developments

News 1:

In March 2024, a leading global 5PL provider announced a strategic partnership with a major AI software firm to co-develop a next-generation predictive logistics platform, aiming to reduce supply chain disruptions by 30% for joint clients.

News 2:

In February 2024, a prominent e-commerce giant signed a comprehensive, multi-year 5PL contract with a logistics integrator to manage its entire European fulfillment and last-mile network, highlighting the shift towards full outsourcing of complex logistics ecosystems.

Key Findings of the Study

- The Retail & E-commercesector is the dominant end-user, driving demand for integrated logistics.

• Integrated IT Platformsform the core solution segment, enabling centralized control and visibility.

• Market growth is fueled by e-commerce expansion and the need for agile, technology-driven supply chains.

• North America and Europe are leading markets, with Asia-Pacific exhibiting the fastest growth.

• Key trends include the adoption of AI for predictive analytics and a focus on end-to-end supply chain resilience.