In recent times, gold has emerged as a favored funding asset, notably in the context of retirement planning. As people search to diversify their portfolios and hedge in opposition to economic uncertainty, Gold Individual Retirement Accounts (IRAs) have gained significant reputation. This article explores the intricacies of Gold IRA transfers, providing insights into their advantages, processes, and concerns recommended options for investing in gold iras traders.

What's a Gold IRA?

A Gold IRA is a kind of self-directed particular person retirement account that enables investors to carry physical gold, together with other treasured metals, as part of their retirement savings. In contrast to traditional IRAs, which usually invest in stocks, bonds, and mutual funds, Gold IRAs present a tangible asset that can act as a hedge in opposition to inflation and market volatility.

The Importance of Gold in Retirement Planning

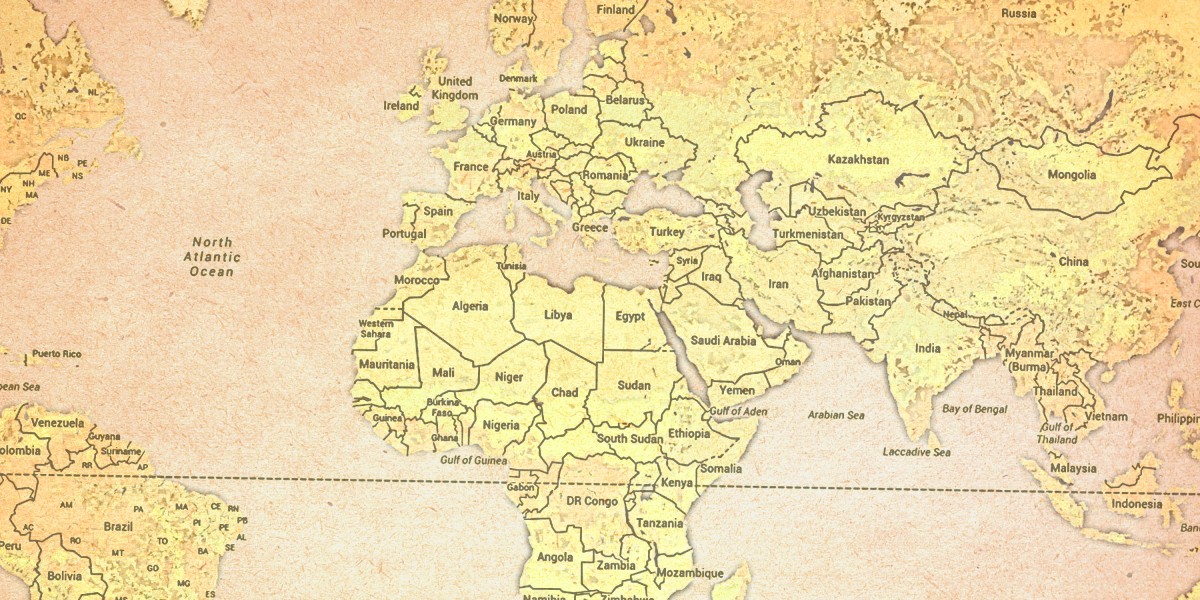

Gold has historically been considered as a secure haven asset. During instances of financial instability, corresponding to recessions or geopolitical tensions, gold costs are inclined to rise as buyers seek stability. If you liked this short article and you desire to get details regarding best companies for ira gold investment generously stop by the web-page. This characteristic makes gold a lovely option for retirement planning, because it may help preserve wealth over the long run.

Moreover, gold can provide diversification advantages. When inventory markets are underperforming, gold typically behaves differently, which may help stability an investment portfolio. By together with gold in a retirement technique, investors can probably scale back total threat and enhance returns.

Understanding Gold IRA Transfers

A Gold IRA transfer refers to the technique of moving funds from an current retirement account into a Gold IRA. This switch can happen in two major forms: a direct switch and a rollover.

- Direct Transfer: In a direct transfer, the funds are moved straight from one custodian to another without the account holder taking possession of the property. This method is generally thought of essentially the most simple and carries no tax implications.

- Rollover: A rollover entails the account holder receiving the funds and then depositing them into a brand new Gold IRA inside 60 days. This technique could be extra complex, as it might trigger tax liabilities if not executed correctly. It is crucial for investors to adhere to IRS laws to keep away from penalties.

Advantages of Gold IRA Transfers

- Diversification: Transferring to a Gold IRA permits buyers to diversify their retirement holdings. By adding physical gold to their portfolio, they will mitigate dangers related to conventional investments.

- Inflation Hedge: Gold has historically maintained its worth during inflationary intervals. By holding gold in an IRA, traders can protect their retirement savings from the eroding effects of inflation.

- Tangible Asset: In contrast to stocks or bonds, gold is a bodily asset that investors can hold. This tangibility can present a sense of safety, especially throughout economic downturns.

- Tax Advantages: Gold IRAs offer tax-deferred progress, meaning that buyers don't pay taxes on any good points until they withdraw funds throughout retirement. This can result in significant tax savings over time.

The Technique of Transferring to a Gold IRA

- Choose a Custodian: Step one within the transfer process is choosing a custodian that focuses on Gold IRAs. It is important to research and select a good firm that offers clear charges and wonderful customer service.

- Open a Gold IRA Account: Once a custodian is chosen, buyers should open a Gold IRA account. This course of usually entails filling out an application and providing mandatory documentation.

- Initiate the Transfer: After establishing the Gold IRA account, the investor can initiate the transfer course of. This often entails completing a switch request form offered by the custodian. For direct transfers, the custodian will handle the paperwork and communication with the existing retirement account supplier.

- Select Gold Investments: After the funds are transferred, investors can select which gold merchandise to incorporate of their IRA. Choices could embrace gold bullion, coins, and other authorized treasured metals.

- Complete the Transaction: Once the gold investments are selected, the custodian will facilitate the purchase and storage of the physical gold in an IRS-accredited depository. It is crucial to ensure that the gold meets the IRS requirements for purity and authenticity.

Concerns When Transferring to a Gold IRA

- Charges and Costs: Investors ought to remember of the fees associated with Gold IRAs, together with setup charges, storage fees, and transaction charges. Understanding these prices is important for evaluating the general value of the investment.

- IRS Laws: The IRS has particular guidelines regarding the types of gold and precious metals that can be held in an IRA. Traders should ensure that their chosen investments comply with these regulations to keep away from penalties.

- Market Volatility: While gold is usually seen as a stable funding, its costs can nonetheless be risky. Investors should consider their risk tolerance and investment horizon before committing to a Gold IRA.

- Storage Choices: Bodily gold must be saved in an IRS-authorised depository. Investors ought to analysis and choose a secure and reputable gold ira investment usa storage facility.

- Seek the advice of a Financial Advisor: Given the complexities of retirement planning and funding methods, consulting with a financial advisor can present priceless insights and assist traders make knowledgeable decisions regarding Gold IRA transfers.

Conclusion

Gold IRA transfers supply a novel opportunity for buyers to diversify their retirement portfolios and hedge in opposition to economic uncertainty. By understanding the method, advantages, and issues involved, people could make knowledgeable choices about incorporating gold into their retirement methods. As with any investment, careful planning and research are important to ensure a successful transition to a Gold IRA. With the correct strategy, traders can harness the potential of gold to secure their financial future in retirement.