IMARC Group has recently released a new research study titled “Canada Asset Management Market Report by Asset Class (Equity, Fixed Income, Alternative Investment, Hybrid, Cash Management), Source of Funds (Pension Funds and Insurance Companies, Individual Investors (Retail+ High Net Worth Clients), Corporate Investors, and Others), Type of Asset Management Firms (Large Financial Institutions/Bulge Brackets Banks, Mutual Funds and ETFs, Private Equity and Venture Capital, Fixed Income Funds, Hedge Funds, and Others), and Region 2025-2033”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

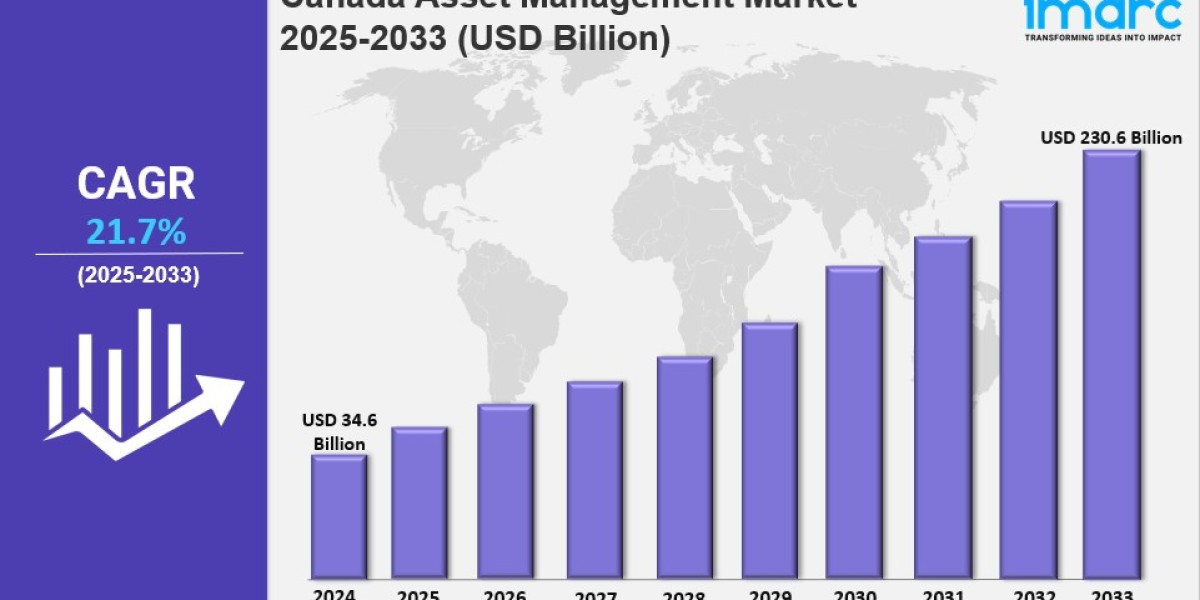

The Canada asset management market share was valued at USD 34.6 Billion in 2024 and is projected to reach USD 230.6 Billion by 2033, growing at a CAGR of 21.7% during the forecast period of 2025-2033. The market expansion is driven by rising demands for comprehensive retirement planning services due to an aging population, alongside increased online retail purchases fostering investment opportunities. These factors are expected to sustain market growth through 2033.

Study Assumption Years

● Base Year: 2024

● Historical Years: 2019-2024

● Forecast Period: 2025-2033

Canada Asset Management Market Key Takeaways

● Current Market Size in 2024: USD 34.6 Billion

● CAGR (2025-2033): 21.7%

● Forecast Period: 2025-2033

● The increasing geriatric population in Canada, with over 7.56 million people aged 65 and above as of July 2023, drives demand for retirement planning services.

● Pension funds and insurance companies increasingly require asset management expertise to meet long-term obligations.

● Online retail purchases reached 55% of Canadians in 2022, promoting investments in e-commerce and related logistic and technology sectors.

● Asset managers diversify portfolios to include companies benefiting from the rise in e-commerce, cloud computing, and cybersecurity.

● Growing retirees prefer investment products providing consistent income streams such as bonds, dividend-paying equities, and REITs.

Sample Request Link: https://www.imarcgroup.com/canada-asset-management-market/requestsample

Canada Asset Management Market Growth Factors

The aging population is a primary factor supporting Canada asset management market growth, as a growing number of individuals seek professional investment management, retirement planning, and wealth preservation solutions across the country. As reported by Statistics Canada, the number of Canadians aged 65 and over reached 7,568,308 in July 2023. It follows that there is a need for retirement planning services and product offerings to provide retirement income, future savings and financial security. To achieve these objectives it is necessary for the public and private pension funds to be managed for the duration of the pension plan obligation to ensure that retirement benefits produce adequate returns. An increasing demand for security and wealth preservation has arisen, with the desire for regular income generation. Asset managers help clients prepare for future expenditures such as healthcare.

In addition, the growing number of online retail purchases is a further reason for the market's growth, with 55% of Canadians making online purchases in 2022. The e-commerce boom has opened the door to investing in companies that ease the adoption of digital technology in retail, logistics and technology. Asset managers are allocating more capital to sectors that benefit from increasing consumer spending, such as delivery firms, cloud and cybersecurity companies, as these sectors are well-positioned from the growth of internet shopping, have high diversification potential, and offer good risk-return profiles.

Asset management companies likewise respond to the retirement population's preference for income-generating investments. Retirees sometimes supplement income with other means when they are no longer in the workforce, e.g. bonds, stocks that produce dividends, or REITs. For asset managers, details of managing the wealth of retirees are a more responsible choice than making high-risk high-return gambles. In this context, asset management provides retirees with the savings and investment strategies needed to cover healthcare and other expenses.

To get more information on this market, Request Sample

Market Segmentation

Breakup By Asset Class:

● Equity: Investments in company stocks, allowing investors to share in corporate profits and growth.

● Fixed Income: Debt securities providing regular interest income with lower risk compared to equities.

● Alternative Investment: Non-traditional assets including private equity, hedge funds, and derivatives.

● Hybrid: Combined asset strategies blending equities and fixed income to balance risk and return.

● Cash Management: Liquid assets management for short-term financial needs and safety.

Breakup By Source of Funds:

● Pension Funds and Insurance Companies: Institutional funds managing retirement and insurance-related assets.

● Individual Investors (Retail+ High Net Worth Clients): Private investors ranging from everyday retail clients to wealthy individuals.

● Corporate Investors: Companies investing surplus funds for growth and capital preservation.

● Others

Breakup By Type of Asset Management Firms:

● Large Financial Institutions/Bulge Brackets Banks: Major banks and financial entities managing diverse asset portfolios.

● Mutual Funds and ETFs: Pooled investment vehicles accessible to a broad investor base.

● Private Equity and Venture Capital: Firms investing in private companies and startups aiming for high growth.

● Fixed Income Funds: Specialized funds focusing on debt instruments with steady returns.

● Hedge Funds: Funds employing aggressive strategies including leverage and derivatives.

● Others

Regional Insights

Ontario, Quebec, Alberta, British Columbia, and other regions constitute the major regional markets analyzed. Specific market statistics such as market share or regional CAGR are not provided explicitly in the source. These regions collectively represent the comprehensive geographic scope of the Canada asset management market with detailed country-level forecasts available in the report.

Recent Developments & News

● June 2023: Ninepoint Partners LP expanded its partnership with Monroe Capital LLC, a private credit asset management firm based in Chicago.

● April 2023: CapIntel formed a strategic partnership with SEI®, a global provider of technology and investment solutions, to enhance sales and marketing processes by using CapIntel’s sales platform.

Key Players

● Ninepoint Partners LP

● Monroe Capital LLC

● CapIntel

● SEI®

Competitive Landscape

The market research report covers a comprehensive competitive landscape analysis including market structure, key player positioning, winning strategies, competitive dashboards, and company evaluation quadrants. Detailed profiles of all major companies have been provided.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=23940&flag=C

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302