Lately, the monetary landscape has seen a major shift in direction of alternative investments, with gold rising as a preferred alternative for a lot of buyers seeking to protect their wealth. Transferring a person Retirement Account (IRA) to gold can be a strategic move, particularly in occasions of economic uncertainty. This article explores the process, advantages, and considerations of converting your IRA right into a gold ira investment companies list-backed account, offering a comprehensive guide for these fascinated in this demonstrable advance in wealth management.

Understanding the basics of IRAs and Gold

An individual Retirement Account (IRA) is a tax-advantaged funding vehicle designed to assist people save for retirement. Traditional IRAs sometimes put money into stocks, bonds, and mutual funds, whereas a Self-Directed IRA (SDIRA) allows for a broader vary of funding choices, including real property, private fairness, and treasured metals like gold.

Gold has long been thought-about a secure-haven asset, especially during economic downturns. Its intrinsic worth, limited supply, and historical efficiency make it an interesting option for diversifying retirement portfolios. By transferring your IRA to gold, you can doubtlessly safeguard your financial savings in opposition to inflation and market volatility.

The Technique of Transferring Your IRA to Gold

- Choose the right Type of IRA: When you at the moment have a conventional IRA, you'll be able to convert it to a Self-Directed IRA that allows gold investments. Alternatively, in case you have a Roth IRA, you too can switch to a Self-Directed Roth IRA affordable options for gold investment ira tax-free growth.

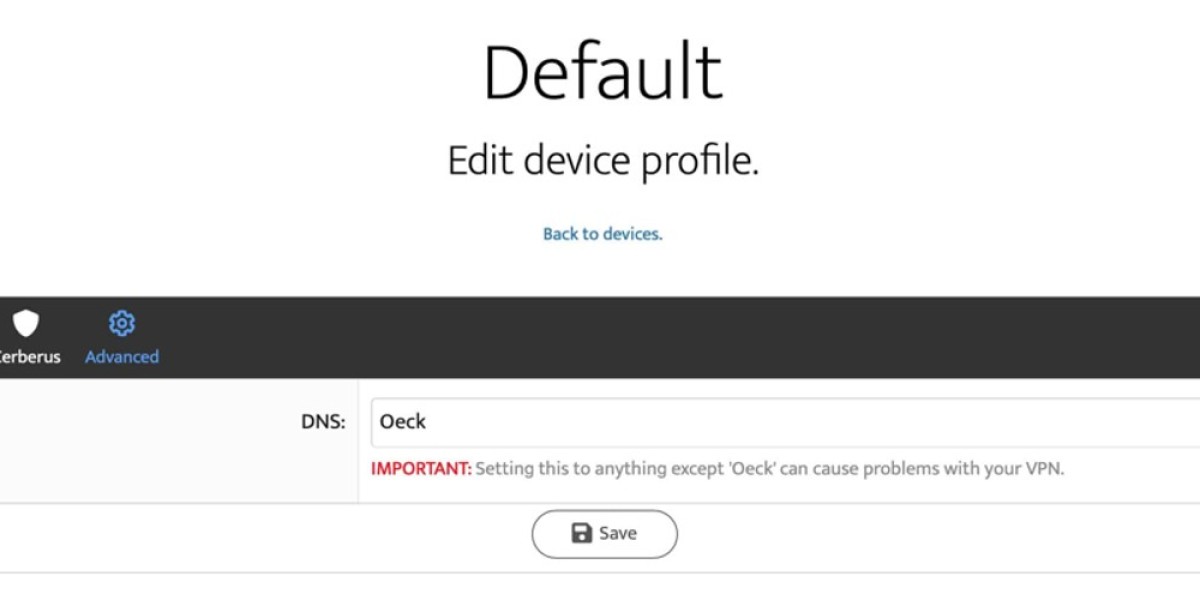

- Select a Custodian: The IRS requires that every one IRAs be held by a qualified custodian. When transferring to a gold IRA, you need to choose a custodian skilled in dealing with valuable metals. In the event you loved this informative article and you would want to receive more information relating to gold ira investment firm rankings assure visit our own web site. Research and compare varied custodians based on charges, customer support, and fame.

- Open Your Gold IRA Account: After deciding on a custodian, you have to to complete the necessary paperwork to open your gold IRA account. This process sometimes entails offering private info, choosing the kind of IRA, and agreeing to the custodian's terms.

- Fund Your Gold IRA: You can fund your new gold diversified ira investment with gold via a direct switch from your existing IRA or by rolling over funds from a 401(okay) or different retirement accounts. Be certain that the transfer is executed correctly to avoid tax penalties.

- Select Your Gold Investments: Once your account is funded, you'll be able to start purchasing gold. The IRS has particular pointers regarding the sorts of gold that can be held in an IRA. Eligible gold should meet certain purity standards (not less than 99.5% pure) and can embody bullion coins, bars, and certain types of gold ETFs.

- Storage of Gold: The IRS mandates that all bodily gold held in an IRA should be saved in an authorised depository. Your custodian will typically assist with the logistics of storing your gold securely. Make certain to understand the storage charges and insurance coverage choices available.

Advantages of Transferring Your IRA to Gold

- Inflation Hedge: Gold has historically maintained its worth throughout durations of inflation. When fiat currencies lose buying energy, gold often appreciates, making it a reliable hedge in opposition to inflation.

- Portfolio Diversification: Including gold in your retirement portfolio can cut back total threat. Gold often has a low correlation with traditional property like stocks and bonds, making it an effective diversification tool.

- Protection Towards Financial Uncertainty: In instances of financial instability, geopolitical tensions, or financial crises, gold tends to carry out properly. Buyers usually flock to gold during market downturns, driving up its price and providing a secure haven for his or her wealth.

- Tax Benefits: By transferring your IRA to gold, you maintain the tax-advantaged standing of your retirement financial savings. Conventional IRAs allow for tax-deferred progress, while Roth IRAs provide tax-free growth, relying on your contributions.

- Management Over Investments: A Self-Directed IRA provides you higher control over your investment choices. You possibly can decide when to purchase or sell gold, permitting for extra strategic determination-making based mostly on market situations.

Issues and Dangers

Whereas transferring your IRA to gold provides numerous benefits, it is important to contemplate potential dangers and challenges:

- Market Volatility: The price of gold might be risky, influenced by numerous elements comparable to financial circumstances, interest rates, and international occasions. Traders ought to be prepared for fluctuations in value.

- Storage and Insurance Costs: Storing bodily gold incurs prices, together with storage fees and insurance. These bills can eat into your investment returns, so it’s crucial to evaluate the general value-effectiveness of holding gold in an IRA.

- Restricted Liquidity: In contrast to stocks or bonds, selling physical gold might take longer and will contain additional costs. Buyers should be aware of the liquidity challenges related to gold investments.

- Regulatory Compliance: The IRS has strict rules governing IRAs, together with those holding gold. Failure to adjust to these rules may end up in penalties or disqualification of the IRA.

- Choosing the right Custodian: Not all custodians are created equal. It’s essential to conduct thorough research and choose a good custodian with experience in valuable metals to ensure a smooth switch course of.

Conclusion

Transferring your IRA to gold can be a strategic move to guard your retirement financial savings and diversify your investment portfolio. Because the financial landscape continues to evolve, gold remains a reliable asset for these seeking stability and growth. By understanding the method, benefits, and potential risks involved, you can make informed selections about incorporating gold into your retirement technique. Whether or not you are a seasoned investor or new to the world of other belongings, a gold-backed IRA can present a useful hedge against economic uncertainty and inflation. With cautious planning and the fitting resources, you possibly can unlock the potential of gold to safe your monetary future.