In recent times, the recognition of Gold and Silver Individual Retirement Accounts (IRAs) has surged as buyers search to diversify their retirement portfolios and protect their wealth against financial uncertainties. Gold and silver have lengthy been considered as safe-haven assets, especially during times of inflation, market volatility, and geopolitical tensions. This article will explore the benefits and concerns of investing in a Gold and Silver IRA, discussing how these treasured metals can play a vital position in a nicely-rounded retirement strategy.

Understanding Gold and Silver IRAs

A Gold and Silver IRA is a self-directed retirement account that allows buyers to hold physical precious metals, comparable to gold and silver, as part of their retirement financial savings. Not like traditional IRAs, which sometimes hold stocks, bonds, and mutual funds, Gold and Silver IRAs provide a unique opportunity to put money into tangible property. One of these IRA is governed by the same guidelines and regulations as other retirement accounts, permitting for tax-deferred progress and potential tax advantages.

The advantages of Gold and Silver IRAs

- Hedge Towards Inflation: One in all the first reasons buyers turn to gold and silver is their historical means to serve as a hedge in opposition to inflation. When the buying power of fiat currencies declines, the value of valuable metals usually rises. As central banks continue to print money and governments implement expansive financial insurance policies, the chance of inflation will increase, making gold and silver a sexy possibility for preserving wealth.

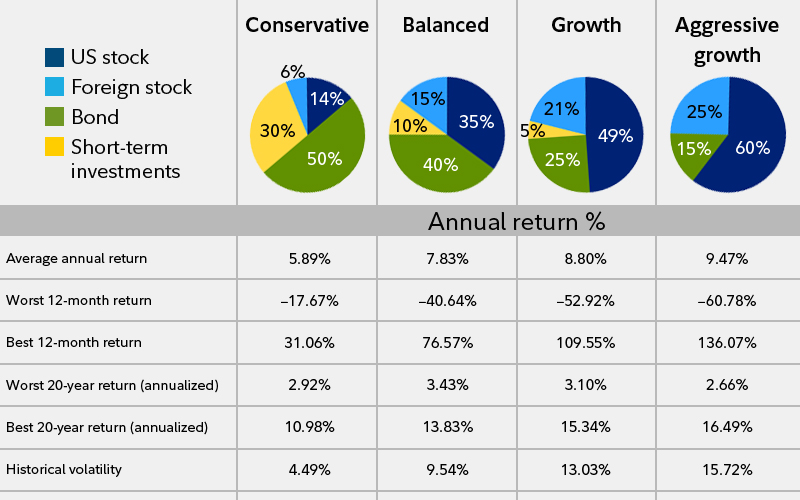

- Portfolio Diversification: Diversification is a elementary precept of investing. By together with gold and silver in a retirement portfolio, traders can reduce general danger. Precious metals usually have a low correlation with traditional asset classes, which means they may carry out well when stocks and bonds decline. This diversification can lead to extra stable returns over time.

- Tangible Belongings: In contrast to stocks or bonds, gold and silver are bodily property that buyers can hold of their fingers. This tangibility can provide a way of security, especially throughout times of economic uncertainty. Many investors appreciate the thought of proudly owning something concrete that has intrinsic worth, as opposed to relying solely on paper belongings.

- Potential for Lengthy-Time period Progress: Whereas gold ira investment for security and silver prices might be volatile in the quick term, they've historically appreciated over the long run. Investors who hold these metals for an extended period could profit from price will increase driven by supply and demand dynamics, geopolitical tensions, and total economic conditions.

- Tax Benefits: Gold and Silver IRAs supply tax-deferred growth, meaning that buyers don't owe taxes on the positive factors until they withdraw funds from the account. Depending on the investor's tax bracket at retirement, this may result in vital tax savings. Additionally, if structured as a Roth IRA, certified withdrawals could be tax-free.

Issues When Investing in Gold and Silver IRAs

- Storage and Security: One of many most significant considerations when investing in a Gold and Silver IRA is the storage of the physical metals. The IRS requires that treasured metals held in an IRA be stored in an accepted depository. This provides an extra layer of price and complexity, as investors should pay for secure storage and insurance coverage. It is important to choose a good depository to ensure the safety of the investment.

- Market Volatility: While gold and silver are often viewed as safe-haven belongings, their prices may be extremely volatile within the brief time period. Investors needs to be prepared for fluctuations in worth and perceive that these metals could not at all times present speedy returns. A long-term funding horizon is typically really helpful for those considering Gold and Silver IRAs.

- Fees and Costs: Organising a Gold and Silver IRA can involve various fees, including account setup charges, storage charges, and transaction fees when shopping for or selling metals. It is essential for buyers to understand these costs and the way they may impression general returns. Evaluating different custodians and their price structures can assist minimize bills.

- Limited Funding reliable options for investing in ira gold: Gold and Silver IRAs are restricted to specific types of treasured metals that meet IRS requirements. For instance, only certain coins and bullion products are eligible for inclusion in an IRA. This limitation can restrict the investment choices available to buyers in comparison with conventional IRAs.

- Regulatory Compliance: Buyers should comply with IRS regulations when managing a Gold and Silver IRA. This includes adhering to rules relating to contributions, distributions, and the varieties of metals that can be held in the account. Failure to comply with these regulations can lead to penalties or disqualification of the IRA.

Conclusion

Gold and Silver IRAs supply investors a singular opportunity to diversify their retirement portfolios and protect their wealth in opposition to financial uncertainties. With the potential for long-term progress, inflation hedging, and the safety of tangible assets, these treasured metals can play a useful position in a complete retirement technique. Nevertheless, buyers must fastidiously consider the associated prices, storage requirements, and market volatility before committing to a Gold and Silver IRA. By doing thorough analysis and consulting with financial advisors, people can make knowledgeable selections that align with their retirement goals and danger tolerance. If you have any kind of concerns regarding where and how to make use of tax-friendly gold ira investment, you could contact us at the website. As with all investment, a nicely-thought-out method will assist maximize the benefits of including gold and silver in a retirement portfolio.