Within the ever-evolving panorama of retirement planning, Gold Individual Retirement Accounts (IRAs) have emerged as a compelling option for buyers trying to diversify their portfolios and safeguard their wealth. With economic uncertainties and inflation concerns on the rise, many individuals are turning to gold as a stable asset class. This article aims to discover the best Gold IRA accounts presently accessible, providing insights into their options, advantages, and issues to help buyers make knowledgeable choices.

Understanding Gold IRAs

A Gold IRA is a specialised sort of retirement account that permits traders to carry bodily gold and other treasured metals as part of their retirement financial savings. Not like conventional IRAs that usually hold paper belongings such as stocks and bonds, Gold IRAs present a tangible asset that may act as a hedge in opposition to inflation and market volatility. This distinctive characteristic has made Gold IRAs more and more widespread among investors seeking lengthy-term financial security.

Benefits of Gold IRAs

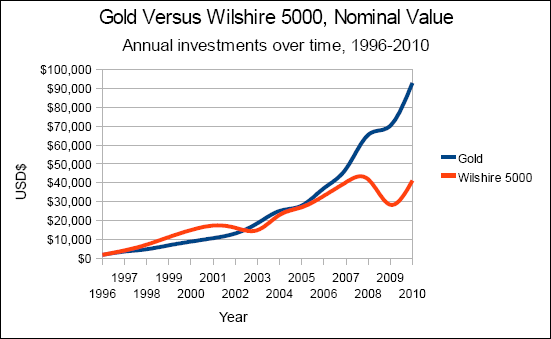

- Inflation Hedge: Gold has historically maintained its worth over time, making it an excellent hedge towards inflation. As the purchasing power of fiat currencies declines, gold tends to appreciate, preserving wealth.

- Portfolio Diversification: Including gold in an investment portfolio can improve diversification. Gold often exhibits a unfavorable correlation with stocks and bonds, that means it could possibly carry out properly when conventional markets wrestle.

- Tangible Asset: Not like digital property, gold is a physical commodity that buyers can hold. This tangibility can present peace of mind, particularly during economic downturns.

- Tax Benefits: Gold IRAs provide the identical tax benefits as traditional IRAs. Contributions may be tax-deductible, and positive factors on investments can develop tax-deferred until withdrawal.

Best Gold IRA Accounts in 2023

As of 2023, a number of corporations stand out within the Gold IRA space, offering aggressive services, fees, and buyer support. Listed below are among the best Gold IRA accounts at present obtainable:

1. Birch Gold Group

Birch gold ira investment guide usa Group has established itself as a pacesetter in the precious metals funding trade. They provide a seamless process for organising a Gold IRA, offering investors with a wide number of gold, silver, platinum, and palladium products.

- Execs:

- Sturdy customer service with dedicated representatives.

- No hidden charges; clear pricing construction.

- Cons:

2. Noble Gold Investments

Noble Gold is thought for its dedication to buyer schooling and service. They offer a variety of treasured metals for IRA investment and provide an easy-to-navigate platform for account management.

- Pros:

- Free gold investment guide out there for brand new buyers.

In case you beloved this short article and you want to receive guidance relating to gold ira investment firm rankings generously go to our own web page. - Robust fame for customer satisfaction.

- Cons:

3. Advantage Gold

Advantage Gold is a newer player within the Gold IRA market however has shortly gained a status for its customer-centered method. They provide a straightforward setup course of and a variety of investment secure options for gold ira investment.

- Execs:

- Competitive pricing and low fees.

- Sturdy emphasis on customer satisfaction.

- Cons:

4. Goldco

Goldco has been in the gold investment area for over a decade and has built a stable popularity for its customer service and expertise. They offer quite a lot of treasured metals for IRA funding and have a easy account setup process.

- Professionals:

- Sturdy educational assets and customer support.

- Competitive charge structure.

- Cons:

5. American Hartford Gold

American Hartford Gold is thought for its commitment to transparency and customer service. They provide a variety of treasured metals for IRA investment and have garnered optimistic critiques for his or her straightforward approach.

- Professionals:

- Strong educational assets for traders.

- Excellent customer service fame.

- Cons:

Elements to think about When Choosing a Gold IRA Account

When deciding on the best Gold IRA account to your needs, consider the following components:

- Fees: Search for transparency in fees, including setup fees, storage charges, and transaction fees. Some corporations may supply decrease fees however have hidden costs.

- Minimum Investment: Totally different corporations have various minimal funding necessities. Choose an organization that aligns together with your funding capability.

- Customer service: A responsive and educated customer support team could make a major difference, especially for first-time investors.

- Instructional Sources: Corporations that present educational supplies may also help traders make informed decisions and perceive the intricacies of treasured metal investing.

- Product Choice: Guarantee the corporate gives a wide range of valuable metals, together with gold, silver, platinum, and palladium, to diversify your funding.

Conclusion

As financial uncertainties proceed to loom, Gold IRAs current a viable possibility for traders searching for to protect and grow their retirement financial savings. By exploring the best Gold IRA accounts out there in 2023, investors can discover an appropriate supplier that meets their needs. With the correct Gold IRA, individuals can enjoy the advantages of diversification, inflation safety, and the security of tangible property. As at all times, it's essential to conduct thorough analysis and consider personal monetary targets before making any investment decisions. With the fitting method and a trusted Gold recommended gold-backed ira companies usa supplier, traders can confidently navigate the complexities of valuable metals investing and safe their financial future.