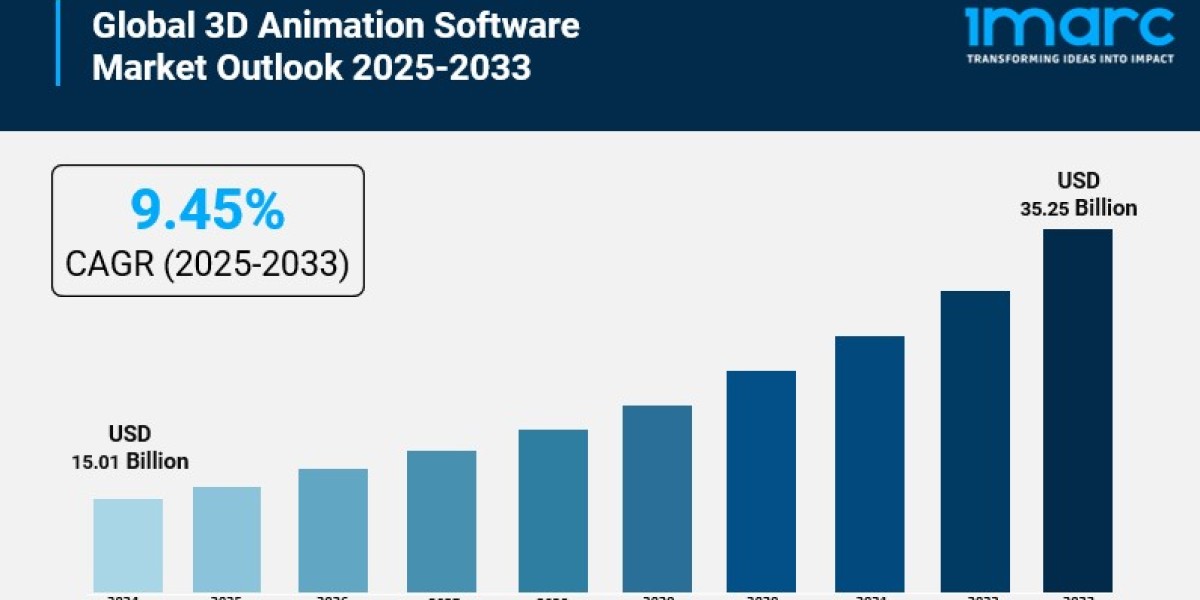

Market Overview

The global 3D Animation Software Market was valued at USD 15.01 Billion in 2024, with projections reaching USD 35.25 Billion by 2033. The market is forecasted to grow at a CAGR of 9.45% during 2025-2033. This growth is driven by increasing demand in gaming, AI-powered automation, real-time rendering, along with rising usage of VR and AR gaming and cloud-based solutions enhancing collaboration.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

3D Animation Software Market Key Takeaways

- Current Market Size: USD 15.01 Billion in 2024

- CAGR: 9.45% during 2025-2033

- Forecast Period: 2025-2033

- North America dominated the market in 2024 with a 38.9% share.

- The gaming industry drives demand through the need for immersive character and environment creation.

- AI and machine learning are automating complex animation processes, reducing production time.

- VR and AR technologies increase demand for realistic and interactive 3D animation content.

- On-premises deployment held 58.7% market share in 2024 due to security and performance needs.

- Media and entertainment is the largest vertical with 37.6% share in 2024.

Request for a Free Sample Report: https://www.imarcgroup.com/3d-animation-software-market/requestsample

Market Growth Factors

Demand rises for visual content of high quality within the entertainment, gaming, advertising, and marketing industries to fuel the 3D animation software market's growth. The gaming industry is one of the major end-user segments behind the demand for 3D animation software to create elaborate characters, environments, and realistic visual effects to improve storytelling. The progress of open-world multiplayer, VR and AR games has continued to drive the demand for 3D animation software, and the growth of cloud-based 3D animation tools allows game developers to collaborate across the world.

Artificial intelligence (AI) and software implementing machine learning (ML) are used in 3D animation software, to speed up workflow processes and better simulate realism. AI can also be used for auto-rigging and motion capture, thus lowering the cost of 3D animation. Examples include DeepMotion's MotionGPT, which creates 3D animations from text prompts, and Spaceblock's animation pack for Unreal Engine Marketplace, which create animated 3D assets through realistic motion capture. The technology lowers the entry bar of animation; allowing animators at small studios or independent animators to create high-quality animation work quickly.

As VR and AR capabilities are integrated into software within the video game industry, entertainment industry and education, services are being introduced that combine 5G telecommunications with VR and AR to increase interactivity of virtual environments, such as AT&T's partnership with NVIDIA Corp to support its 5G cloud gaming services, targeting premium gaming content. The use of virtual reality (VR) and augmented reality (AR) in business' training or simulation purposes requires advanced animation packages to create scenarios and interactions that look and feel real, thus driving the market.

Market Segmentation

Analysis by Technology:

- 3D Modeling: Leads with 33.2% market share in 2024, crucial for gaming, filmmaking, architecture, and product design by providing precise and lifelike character and environment creation.

- Motion Graphics: Not specifically detailed beyond listing.

- 3D Rendering: Not specifically detailed beyond listing.

- Visual Effects (VFX): Not specifically detailed beyond listing.

- Others: Not specifically detailed beyond listing.

Analysis by Service:

- Consulting: Not specifically detailed beyond listing.

- Support and Maintenance: Not specifically detailed beyond listing.

- Integration and Deployment: Not specifically detailed beyond listing.

- Education and Training: Vital for teaching experts and students complex animation software use, including certification courses, online resources, and university programs.

Analysis by Deployment:

- On-premises: Dominates market with 58.7% share in 2024, preferred for data confidentiality, high-end rendering, cybersecurity, and integration with specialized hardware.

- Cloud-based: Not specifically detailed beyond listing.

Analysis by Vertical:

- Media and Entertainment: Leads with 37.6% market share in 2024, driven by high-budget films, animated movies, gaming, streaming platforms and the growing popularity of VR and AR applications.

- Construction and Architecture: Not detailed beyond listing.

- Healthcare and Lifesciences: Not detailed beyond listing.

- Manufacturing: Not detailed beyond listing.

- Education and Research: Not detailed beyond listing.

- Others: Not detailed beyond listing.

Regional Insights

In 2024, North America held the largest market share in 3D animation software with 38.9%. Its share is led by a number of top animation, gaming, and VFX studios. The demand for CGI for Hollywood studios and the rise of streaming services motivates an abundance of innovative software. Further, the development of global infrastructure and high-speed internet makes the use of cloud-based animation technology possible. In North America, the United States has 88.30% of the market share, supported by the media and entertainment industry, valued at USD 649 billion in 2022, and a strong digital content creation ecosystem.

Recent Developments & News

In October 2024, Antwerp-based Swoove Studios secured $7.5 million (€6.9 million) in initial funding, totaling $11 million (€10.1 million). Swoove’s AI-powered platform simplifies custom 3D animation video creation, broadening accessibility. In October 2024, Wonder Dynamics, acquired by Autodesk, launched Wonder Animation, enabling filmmakers to convert standard videos into fully editable 3D sequences with advanced animation features. In August 2024, Samsung introduced ten AI-powered Bespoke washing machines in India, including a 12 Kg AI Wash variant priced from INR 52,990 (USD 609.56), enhancing performance and user convenience.

Key Players

- Adobe Systems Inc.

- Autodesk Inc.

- Autodessys Inc.

- Corel Corporation

- Maxon Computer

- Newtek Inc.

- Nvidia Corporation

- Pixologic Inc.

- Sidefx Software

- The Foundry Visionmongers Ltd.

- Toon Boom Animation Inc.

- Trimble Navigation Ltd.

- Zco Corporation

Customization Note:

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

3d animation software market size

3d animation software market share

3d animation software market report